Baroda health is a health insurance policy for Bank of Baroda account holders, in tie up with national Insurance company Limited. After analyzing some of the health insurance policies by nationalized banks for their customers, I have concluded that you can never find a single policy having all the important features.

If one is coming with No sub limits then it doesn’t have high sum assured, and if some policy has high sum assured than it is with sub limits on room rent and other conditions.

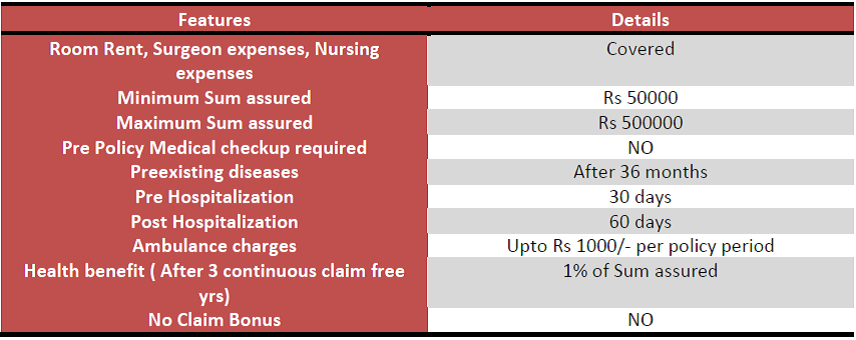

Bank of Baroda health insurance policy comes in the former category. The maximum sum assured one can have under this policy is Rs 5 lakh, though there are no sub limits.

This post is to share with you the basic features and Premium details of the Bank of Baroda mediclaim.

If you have a bank account with any other nationalized bank in India, then you may check their health insurance policy products too. I have reviewed some of them as under

Baroda health is a very Simple policy which covers the hospitalization expenses of the Insured, with no sub limit. It is a floater policy covering the immediate family of 4. Parents cannot be covered under this policy.

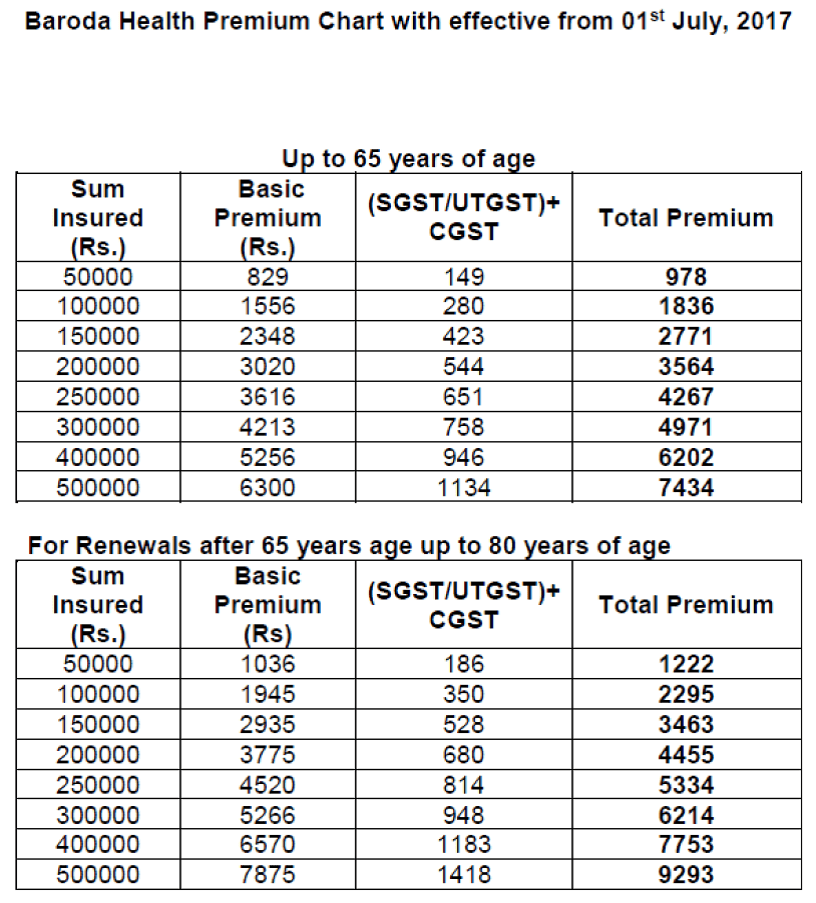

The Premium rates remain same for all age groups till 65 years of age and changes after then. Though the policy states that it will provide coverage only till 80 years of age, but legally no company can refuse continuous coverage, and if the policy holder wants to continue the policy even after 80 years of age, he/she can. This may or may not be with some extra premium.

Click here to Read the Policy wordings

See, product wise there is not much difference between these banks provided policies and otherwise available policies directly from the company. It’s just that bank is acting as a distributor here, and the product is specifically designed for the bank customers.

Being a group policy, the premium rates are also very attractive, and the provision of converting this group policy to Individual policy otherwise provided by the same Insurer is the added advantage, if you want to come out of this group policy due to some reasons or if the Company wants to discontinue the tie up policies.

The main concern with these bank policies are the service issues. Bankers who are selling these policies are not that very conversant with the features and service concerns, and they direct the customers to the TPAs. I have heard many bad experiences with TPAs.

So all in all, this bank of Baroda health insurance policy looks fine, but one should buy this only after knowing all the claim related formalities as you might not get any service from the bankers and process has to be handled by Insured or relatives only.

He’s MBA ( Finance) gold medalist, a CERTIFIED FINANCIAL PLANNER, Chartered Trust and Estate Planner and SEBI Registered Investment adviser. He has authored a Book in collaboration with CNBC TV 18 Network 18 bestesellers , tiltled "The Art of Being Good with Money". An ex banker , having a 17+ years of long experience in financial services industry he manages clients across the globe. He is a regular contributor to various leading Media and publication houses. He has written for Moneycontrol, Dainik bhaskar, Business standard, Live mint, Indian Express, The Tribune etc. He has also appeared in TV shows by Zee Business, ET Money, National Door darshan, Jagran Online. He also delivers training on Various personal finance topics to various corporate houses. You may get in touch with him at [email protected]

The Mediclaim policy of BOB is costlier than that of PNB Oriental Royal Mediclaim if you are above 65 years old. For a cover of Rs.5.00 lakhs, you have to pay 36% more premium than PNB policy every year. Thus if you have good health and making your first claim at the age of 75 years only, you would have already paid Rs.32000/- more premium to BOB because of the higher premium after 65 years.But if it is true that there are no ceiling/sub limits for Room Rent, Surgeon Expenses, Nursing Expenses etc , BOB policy is better. Domiciliary treatments are reimbursed in PNB’s policy, but not in BOB’s.

I think Domiciliary treatment cover is there in BOB too. Ask this to the Insurer while enquiring about this policy.

Can a person above 65 PORT his/her medical insurance to any other medical policy ?My parents have account in BOB. Father’s age is 70 years and Mother’s age 58 years. Will both be covered in floater policy and what will be the final premium ?? Confusion because father is above 65 years and mother is below 65 years of age. Pl clarify..Thanks and Regards

Hi. My Father is 67 years and Mother is 58 years old. As per BOB Health insurance policy rule, an account holder with the age of upto 65 can take the policy.

So as per this clause, my father can not take this policy.

If my mother takes the policy then will my father will also be covered under the same policy? Please guide on the same. Thanks & Regards

try pnb & new india insurance policy where age limit is 79 yr…for more info, please visit PNB (it’s too new so might be some branch people are not aware)

Dear sir, recently my father’s cash less claim is rejected by national insurance (Tpa) stating that “1st year policy as break of 6 months as per mail from ic , attached,chronocity can not be ruled out,hence denied”. My father had already paid 5 years premium, but last premium is paid after break of six.

Please guide is there any chance of reimbursement claim will acceptance??

Your revert is highly appreciated..

09904596290/ [email protected]

Hi, My father is 76 year old and he have a NICL Barishta (sum assured 1 lakh / critical 2lac ) plan from last 5 years. Now he want to port his policy to Bank of Boroda / NICL plan.

My question is – (1) if he port his policy, BOB health policy continue all his previous credential of continuation of last 5 years? (2) can he continue his policy after his 80 year?

Please guide me as early as possible, its really urgent.

MY AGE 48 AND MY WIFE AGE 39 PLS Please check with BOB people for the final premium amount UPTO 2.50 LAC. Pls resend the massge

MY AGE 48 AND MY WIFE AGE 39 PLS Please check with BOB people for the final premium amount UPTO 2.50 LAC.

Kindly let me know which is better insurer, govt. aided insurer(Like baroda health) or private sector insurers like Apolo munich.

It would be more helpful if you can add some brief reason.

Your reply will be awaited.

I have oriental bank of commerce mediclaim (Family Flotar, sum insured Rs. 4 lakhs, with 2 continuous year without any break) policy.

My policy next renewal due date is 25th May 2018. I want to port my policy to Baroda health Policy with same family floater scheme and same sum insured).

So my question is that should I get 2 year continuous benefit of Pre-existing diseases and Critical illness? Please advise me.

My Mediclaim policy expired in February due to some mistake. We want it to be renewed. My husband age is 67 years and mine 60years. Can it be done after paying any penalty. I was member since last 15 years. Please advise if there is some way. Thanks

I have a mediclaim policy of Bank of Baroda under National insurance ,my policy date 16.11.2016,my wife now ill with severe nerve problem ,

pl inform me can I claim the expenditure for treatment such as operation.

You should better apply for the Pre-authorisation of the treatment by emailing them to the Insurer. If the problem does not come under waiting list then claiming should not be a problem

I have Bank of Baroda Health policy No.154501501810002846 , what is the Format of policy such number not showing in the National Insurance website. Message is showing it is not correct numbers.

Dear sir, I am account holder in bank of baroda,but my mother is not account holder in bank of baroda,

can i give for my mother national insurance health policy Cheques from my account.

My mother age is 62 years.

Kindly reply asap.

Thanks

Ganga suryawanshi

My father and mother in full pressure all of sudden… Bank of baroda closed this tie with national insurance.. So my parents who is senior citizens and nt earning good told to pay 3 times higher then wht thy are paying currently. This like loot.. How can bank of board close this group insurance and why not national insurance continue with same amount for old customers.. Earlier premium 6200 and now they are asking 19500.. Is this loot as all know senior citizens insurance is compulsory.. How can thy afford so much high premium and arrange the much money is short notice.

Even I had a Baroda Health insurance policy with Bank of Baroda for last 10 years or more. I am now 68 years and suddenly when I went to renew my policy with effect from 30 Jan 2019, I was told the insurance company has closed this. Neither the insurance company nor the Bank intimated about the closure. As per my last policy, it is valid up to 30 Jan 2019 and I had gone to renew the same one month in advance when I was told about the closure of the scheme. I was surprised at this I’ll treatment of customers. I did not know about this and I still am not aware as to when this scheme was closed. What if I had fallen I’ll and gone to a hospital for treatment not knowing about the closure. How humiliating it would have been for me when it would have beenrejected. Hope Bank and the Insurance companies show more concern for their customers

I understand your concern, but this is the drawback of group policies. As far as claim settlement is concerned, the insurance company cannot deny this as long as your policy is in active mode. Even at the time of renewal, you must have been offered with porting your policy to some other product of insurer with all the continuity benefit. So that way the company manages its liabilities

Dear Sir, Please review OBC- Chola MS health insurance. They are offering 5 lac family floater without parents for Rs 9910 (including GST). No room capping, no sub limits, no co pay, even maternity coverage after 9 months max 25k. Please update on this policy.

Very sorry to say there is no faith about bank of Baroda s any policy my policy is 8 years old.now knowing there is break of tie with national insurance ..Singal ji is saying it’s a drawback of group policy…..

Sir I am existing Mediclaim policy holder since 10 years tieup with baroda bank.BeforeTwo to three months ago I have recd letter from Your Insurance co.that,no further extension will be recd to continue the policy after dec,2018.My policy is due for renewal in 6/2019.Pl.inform me ,whether can cotinue the same or not.

I have also same issue?? Then what to do , adviceSir I am existing Mediclaim policy holder since 10 years tieup with baroda bank.BeforeTwo to three months ago I have recd letter from Your Insurance co.that,no further extension will be recd to continue the policy after dec,2018.My policy is due for renewal in 6/2019.Pl.inform me ,whether can i cotinue the same or not.

Sir, I am not from any Insurance company. But regarding your issue, I can only say that the letter you have received must have a mention of some policy where you can shift and continue with your accumulated benefits. You have no option but to move to that product if you want to enjoy the continuity benefits

Bhupendrakumar harilal jariwala age 61, daxaben bhupendrakumar jariwala 58,this my parents and need a Mediclaim because now at that time national insurance Mediclaim policy & his continue bank of Baroda Mediclaim policy so please contact me ankur bhupendrakumar jariwala

My policy in continuespeople will loos trust on government psu banks and psu insurance company . this is cheating with banks account holder by banks and insurance company

i have bank of baroda health police due on november 2019 but i am out of country and came on january so i want to extend my police.now how can i pay and extend police?

Hi. Got to know from the reader’s comments only that the Bank of Baroda policy has been discontinued. So the Insurer must have offered to port the policy to their other existing product. Please be in touch with the insurance company. Write email to the bank as well as the Insurer, to get the clarification.

sr I am living in USA I am cover with my USA insurance so i not need to cover in India by bank of baroda health insurnace Pl. cancelled my coverage insurance immiedately my Ex.husband Mr. Ramesh M Bhatt s,EC no 1667 If ineed priscribe form for cancelled the insurance pl. send me the form by my email add. my email [email protected] . it was totally mis understood i dont have any pension income i keep my bank of baroda account only my rundown flat mentanations in Kandivalli my email add [email protected]

Hi Baroda health policy which is discontinued was covering the Ayush (Ayurveda) treatment cover or not?

SIR,

I & MY FAMILY IS INSURED WITH BARODA HEALTH POLICY FOR RS. 5 LAC. FOR LAST 9 YEARS,

NOW NEXT RENEWAL DUE ON 30 DEC’2019. I KNEW THAT BOB HAS DISCONTIUNED THE HEALTH POLICY

WITH NATIONAL INSURANCE TIE-UP.

PL. GUIDE ME THAT WHERE I SHOULD RENEW OR PORT MY MEDICLAIM POLICY SO THAT I WOULD NOT SUFFER MY POLICY BENEFITS.

You may contact the insurer directly, they would help you port to some of their other products, so that you can enjoy the accrued benefits of the policy.

I have medical health policy from new India insurance. I have saving Account in BOB. Can I transfer my medical policy in BOB. My age is 51 and my wife age is 49. How much Amount?

This is a group health insurance policy. Individual health policies are non transferable to group policies.

This site uses Akismet to reduce spam. Learn how your comment data is processed.